Predefined Rating Scales¶

The transitionMatrix package supports a variety of credit rating scales. They are grouped together in transitionMatrix.creditratings.creditsystems.

The key ones are described here in more detail.

Rating Scales currently covered¶

The focus of the current selection is on long-term issuer ratings scales (others will be added):

- AM Best Europe-Rating Services Ltd.

- ARC Ratings S.A.

- Cerved Rating Agency S.p.A.

- Creditreform Rating AG

- DBRS Ratings Limited

- Fitch Ratings

- Moody’s Investors Service

- Scope Ratings AG

- Standard & Poor’s Ratings Services

Data per Scale¶

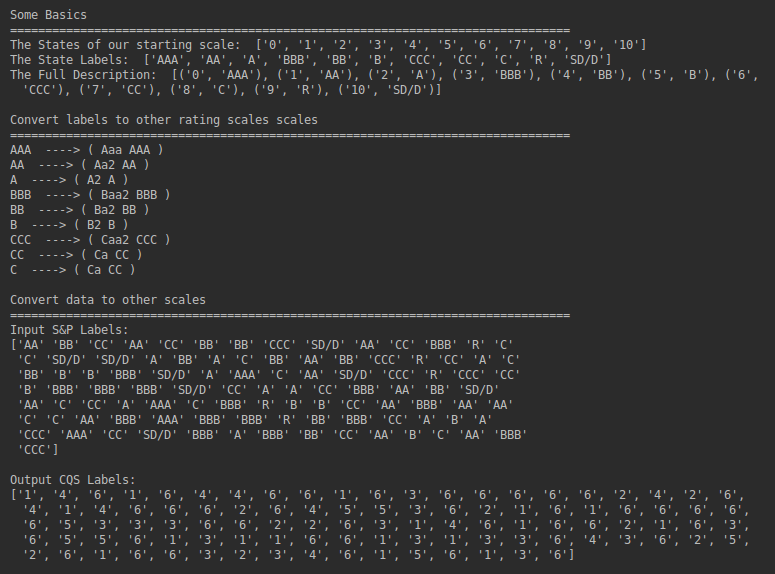

Each rating scale is a StateSpace (see State Spaces) and thus inherits the attributes and methods of that object, namely:

- The entity defining the scale (the originating entity)

- The full name of the scale (as most originators of rating scales offer multiple scales with different meaning an/or use)

- The definition of the scale (as a list of tuples in the form [(‘0’, ‘X1’), … , (‘N-1’, ‘XN)] where X are the symbols used to denote the credit state

- The CQS (credit quality step) mapping of the scale as defined by regulatory authorities (see next section)

CQS Mappings¶

The Credit Quality Step (CQS) denotes a standardised indicator of Credit Risk that is recognized in the European Union

- The CQS Credit Rating Scale is based on numbers, ranging from 1 to 6.

- 1 is the highest quality, 6 is the lowest quality

The European Supervisory Authorities maintain mappings between credit rating agencies and CQS

Note

Consult the original documents from definitive mappings available at the EBA Website

The Rating Agency State Spaces and mappings are obtained from the latest (20 May 2019) Regulatory Reference:

JC 2018 11, FINAL REPORT: REVISED DRAFT ITS ON THE MAPPING OF ECAIS’ CREDIT ASSESSMENTS UNDER CRR